|

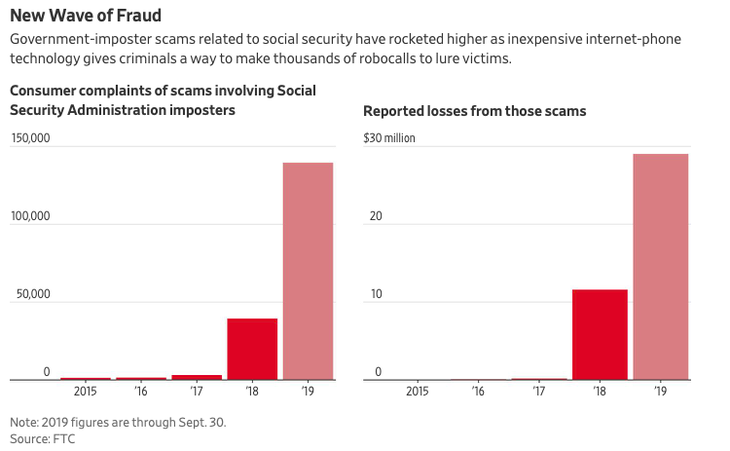

The Wall Street Journal last year shared a heart-wrenching story of financial ruin, when a 60 year-old nurse paid scammers $340,000. Scams are on the rise in the past few years, and it's important now more than ever for tax payers to be aware. In the chart below from the Wall Street Journal, reported losses from scammers has grown to nearly $30 million. Tax scammers work year-round, not just during tax season and target virtually everyone. Stay alert to the ways criminals pose as the IRS to trick you out of your money or personal information.  Source: https://www.wsj.com/articles/robocall-scams-exist-because-they-workone-womans-story-shows-how-11574351204 Source: https://www.wsj.com/articles/robocall-scams-exist-because-they-workone-womans-story-shows-how-11574351204 IRS-Impersonation Telephone Scam An aggressive and sophisticated telephone scam targeting taxpayers, including recent immigrants, has been making the rounds throughout the country. Callers claim to be employees of the IRS, but are not. These con artists can sound convincing when they call. They use fake names and bogus IRS identification badge numbers. They may know a lot about their targets from information gathered from online resources, and they usually alter the caller ID (caller ID spoofing) to make it look like the IRS is calling. Also, if the phone is not answered, the scammers often leave an urgent callback request. Victims are often told they owe money to the IRS and it must be paid promptly through a pre-loaded debit card, gift card, or wire transfer. If the victim refuses to cooperate, they are then threatened with arrest, deportation, or suspension of a business or driver’s license. In many cases, the caller becomes hostile and insulting. Alternatively, victims may be told they have a refund due to try to trick them into sharing private financial information.

What to do. If you receive a phone call from someone claiming to be from the IRS and asking for money, take the following steps.

Phony IRS Emails—“Phishing” Scammers copy official IRS letterhead to use in emails they send to victims. Emails direct the consumer to a web link that requests personal and financial information, such as a Social Security Number, bank account, or credit card numbers. The practice of tricking victims into revealing private personal and financial in- formation over the internet is known as “phishing” for information. The IRS does not notify taxpayers of refunds or payments due via email. Additionally, taxpayers do not have to complete a special form or provide detailed financial information to obtain a refund. Refunds are based on information contained on the federal income tax return filed by the taxpayer. The IRS never asks people for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts. What to do. If you receive an email from someone claiming to be from the IRS and asking for money, take the following steps:

Abusive tax shelters. Avoid using abusive tax structures to avoid paying taxes. The IRS is committed to stopping complex tax avoidance schemes and the people who create and sell them. The vast majority of tax- payers pay their fair share, and everyone should be on the lookout for people peddling tax shelters that sound too good to be true. When in doubt, taxpayers should seek an independent opinion regarding complex products they are offered. Frivolous tax arguments. Avoid using frivolous tax arguments to avoid paying taxes. Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims to avoid paying the taxes they owe. These arguments are wrong and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to dis- obey the law or disregard their responsibility to pay tax- es. The penalty for filing a frivolous tax return is $5,000. Ways to Protect Yourself From Scams There are many precautions you can take to protect yourself from becoming a victim. These include:

Need tax advice? We're here to help.

7 Comments

Earlier this week, Elon Musk suggested Bitcoin and other cryptocurrencies were “clever” and a plausible replacement for cash. While an endorsement from a genius, billionaire is interesting, virtual currency is still hardly legal tender.

When a currency is legally recognized by a government to be valid for meeting a financial obligation, it is called legal tender. Coins and banknotes are usually defined as legal tender in most countries. Legal tender is backed by a central government, and the government controls the supply. Bitcoin and other virtual currencies are not legal tender and they are not backed by a central government or bank. They are decentralized and are global. For federal income tax purposes, transactions using virtual currency must be reported in U.S. dollars. You will be required to determine the fair market value (FMV) as of the date of payment or receipt of the virtual currency.

|

Archives

July 2023

Categories |

© COPYRIGHT 1993-2020, Warner Tax Group. All rights reserved.

Website by TeeDub Web Designs

RSS Feed

RSS Feed