|

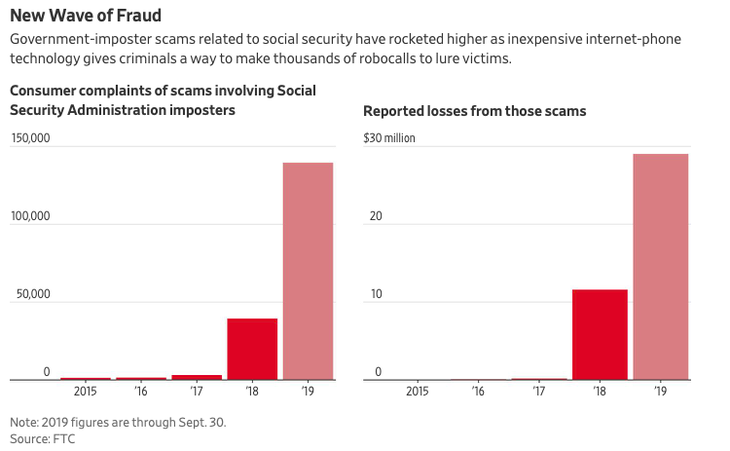

The Wall Street Journal last year shared a heart-wrenching story of financial ruin, when a 60 year-old nurse paid scammers $340,000. Scams are on the rise in the past few years, and it's important now more than ever for tax payers to be aware. In the chart below from the Wall Street Journal, reported losses from scammers has grown to nearly $30 million. Tax scammers work year-round, not just during tax season and target virtually everyone. Stay alert to the ways criminals pose as the IRS to trick you out of your money or personal information.  Source: https://www.wsj.com/articles/robocall-scams-exist-because-they-workone-womans-story-shows-how-11574351204 Source: https://www.wsj.com/articles/robocall-scams-exist-because-they-workone-womans-story-shows-how-11574351204 IRS-Impersonation Telephone Scam An aggressive and sophisticated telephone scam targeting taxpayers, including recent immigrants, has been making the rounds throughout the country. Callers claim to be employees of the IRS, but are not. These con artists can sound convincing when they call. They use fake names and bogus IRS identification badge numbers. They may know a lot about their targets from information gathered from online resources, and they usually alter the caller ID (caller ID spoofing) to make it look like the IRS is calling. Also, if the phone is not answered, the scammers often leave an urgent callback request. Victims are often told they owe money to the IRS and it must be paid promptly through a pre-loaded debit card, gift card, or wire transfer. If the victim refuses to cooperate, they are then threatened with arrest, deportation, or suspension of a business or driver’s license. In many cases, the caller becomes hostile and insulting. Alternatively, victims may be told they have a refund due to try to trick them into sharing private financial information.

What to do. If you receive a phone call from someone claiming to be from the IRS and asking for money, take the following steps.

Phony IRS Emails—“Phishing” Scammers copy official IRS letterhead to use in emails they send to victims. Emails direct the consumer to a web link that requests personal and financial information, such as a Social Security Number, bank account, or credit card numbers. The practice of tricking victims into revealing private personal and financial in- formation over the internet is known as “phishing” for information. The IRS does not notify taxpayers of refunds or payments due via email. Additionally, taxpayers do not have to complete a special form or provide detailed financial information to obtain a refund. Refunds are based on information contained on the federal income tax return filed by the taxpayer. The IRS never asks people for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts. What to do. If you receive an email from someone claiming to be from the IRS and asking for money, take the following steps:

Abusive tax shelters. Avoid using abusive tax structures to avoid paying taxes. The IRS is committed to stopping complex tax avoidance schemes and the people who create and sell them. The vast majority of tax- payers pay their fair share, and everyone should be on the lookout for people peddling tax shelters that sound too good to be true. When in doubt, taxpayers should seek an independent opinion regarding complex products they are offered. Frivolous tax arguments. Avoid using frivolous tax arguments to avoid paying taxes. Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims to avoid paying the taxes they owe. These arguments are wrong and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to dis- obey the law or disregard their responsibility to pay tax- es. The penalty for filing a frivolous tax return is $5,000. Ways to Protect Yourself From Scams There are many precautions you can take to protect yourself from becoming a victim. These include:

Need tax advice? We're here to help.

7 Comments

6/17/2020 04:02:12 pm

Thanks for your tips on how to protect me from scams. I like the tip about checking your credit report yearly. I am having some tax troubles, so I will reach out to an accountant for help.

Reply

9/6/2020 04:26:19 pm

Please Avoid using frivolous tax arguments to avoid paying taxes. Promoters of frivolous schemes encourage taxpayers to make unreasonable and outlandish claims to avoid paying the taxes they owe. These arguments are wrong and have been thrown out of court. While taxpayers have the right to contest their tax liabilities in court, no one has the right to dis- obey the law or disregard their responsibility to pay tax- es.

Reply

2/3/2021 11:03:21 pm

Thanks for your tips on how to protect from the scams. We also provide Accounting & tax consultant services. We understand the good deliberation behind your writing. Thank you for sharing.

Reply

5/27/2021 09:08:21 pm

Reply

9/9/2021 03:17:10 am

I in addition to my friends have already been studying the good key points located on your web site and immediately got a terrible feeling I never thanked the blog owner for those tips.

Reply

9/27/2021 09:24:06 am

My friend has been having a hard time getting his taxes together. It makes sense that I would want to get an accountant to help out with things. I can see how putting things together wrong could cause problems.

Reply

Leave a Reply. |

Archives

July 2023

Categories |

RSS Feed

RSS Feed