|

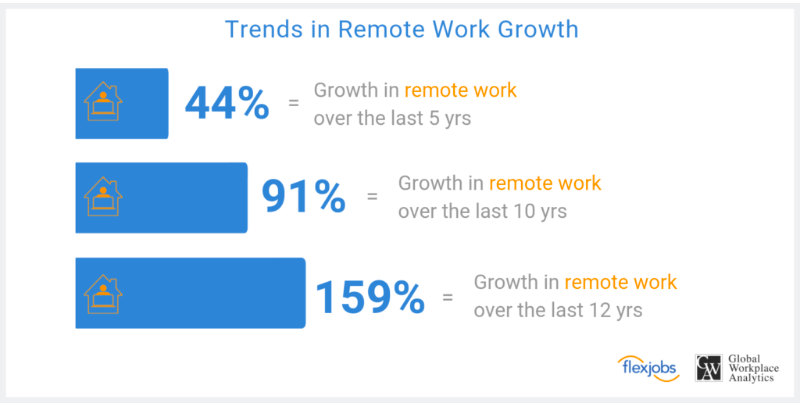

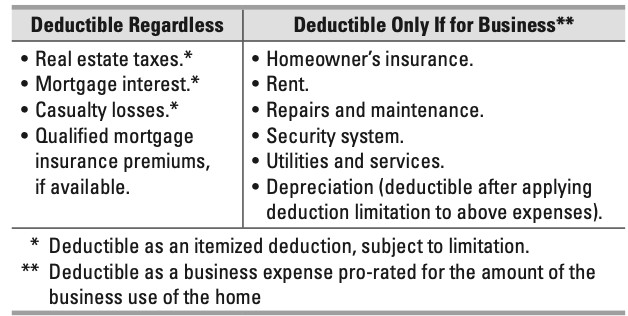

Remote work is on the rise, and this has implications to your tax deductions. According to a survey done by FlexJobs.com and Global Workplace Analytics, remote work has spiked 159% between 2005 and 2017. Not only that, but remote work is impacting real estate. A report completed by Zillow indicated that more than half of home buyers who work remotely say remote work has influenced a major home change. Some expenses are deductible whether or not you use your home for business. Others are deductible only if the home is used for business. So what's deductible?Direct Expenses Expenses that benefit only the area exclusively used for business, such as painting or repairs in the home office, are direct expenses that are fully deductible. Indirect Expenses Expenses for keeping up and running the entire home, such as insurance, utilities, and general repairs, are in- direct expenses that are deductible based on the per- centage of the home used for business. Unrelated Expenses Expenses for the part of the home not used for business, such as lawn care or painting a room not used for busi- ness, are unrelated expenses that are not deductible. Telephone The basic local telephone service for the first telephone line is nondeductible even if it is used for business. Any additional charges for long distance or a second line into the home used for business are deductible. Any de- ductible telephone costs are not included as business use of home cost. Depreciation A qualified home office is considered nonresidential real property depreciable over 39 years. For home of- fice depreciation, the basis in the home is the smaller of:

Calculating Business Use of Home DeductionBusiness Percentage The business percentage equals the area of the part of the home used for business divided by the area of the whole house. Any reasonable method may be used to determine the business percentage. The following are two common methods.

Do not include home expenses in the business use equa- tion for any period during the year where the home was not used for business. Day Care Facility The business percentage of an area exclusively used for business in a day care facility is calculated under the business percentage method above. For the portion of the home regularly used, but not exclusively used for the day care business, multiply that portion by the busi- ness percentage of time. Example: Jane uses her 1,600 square foot basement for her daycare business. The total area of her home is 3,200 square feet so her business-use percentage is 50% (1,600 ÷ 3,200). Her daycare used the basement for a total of 3,000 hours during the year. The total number of hours for the year was 8,760 (24 hours × 365 days) so her daycare time percentage is 34.25% (3,000 ÷ 8,760). Any direct expenses, such as repaint- ing the basement, are multiplied by 34.25% to determine the deductible business portion of the expense. Any indirect ex- penses, such as utilities, are multiplied by 17.13% (50% × 34.25%) to determine the deductible business portion of the expense. Calculating Time Spent on Day Care You should keep a log reflecting time spent conducting the day care business, including dates and hours each person was in your care, and additional time spent orga- nizing, preparing meals, and cleaning up. Deduction Limitation The business use of home deduction is limited to net income from the business. Carryover of Unallowed Expenses Deductions not allowed due to the net income limitation are carried over to the following year. They are added to current expenses from each category and subject to the deduction limit for that year for that category, whether or not you live in the same home during that year. Simplified Option for Home Office Deduction The simplified option for the home office deduction may be calculated as follows:

Note: Although recordkeeping is simplified, this option does not change the criteria for who may claim a home office deduction. Have a question?

|

Archives

July 2023

Categories |

RSS Feed

RSS Feed